Resident Services

The Resident Services Department is constantly expanding its program offerings to meet the needs of the resident population. Through SHA’s non- profit partnerships, the Resident Services department is offering training programs that will enhance adult participants’ life skills and develop additional job readiness skills that will lead to employment and ultimately a better quality of life. Our Resident Services Department also offers Youth Programs such as After-school Tutoring, a Summer Enrichment program, and other educational and life-enriching opportunities on select weekends and school holidays.

We are always looking for employer partners, guest speakers, and other community leaders to assist in this very worthwhile and rewarding mission. If you would like to assist or make donations to the Resident Services Department, please feel free to call (941) 361-6210 or e-mail us.

Resident Services Staff

Funding Partners

Education Partners

Non-Profit Partners

Agency Partners

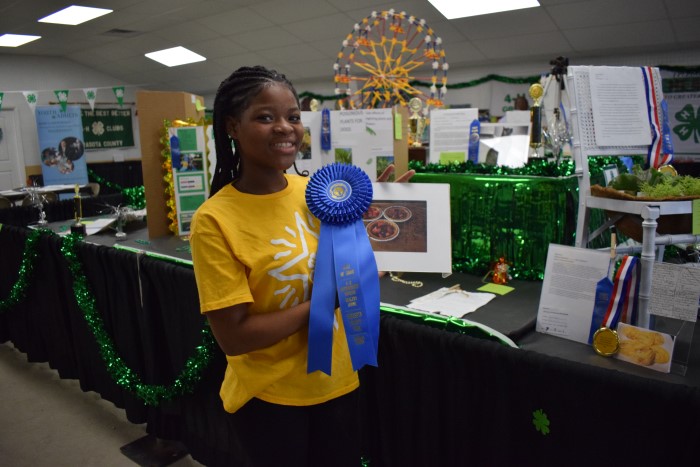

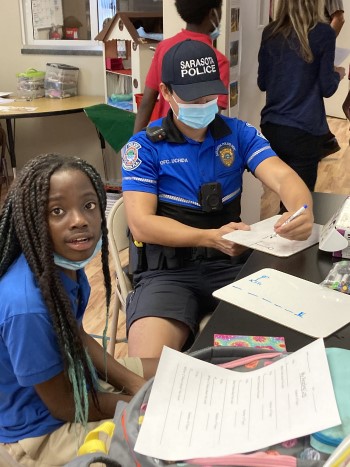

Youth Thrive

The purpose of Sarasota Housing Authority’s Youth Thrive program is to engage young people, enrich their lives, inspire them to dream and empower them to set and work toward goals that will enable them to break the intergenerational cycle of poverty. SHA Youth Thrive seeks to accomplish this by offering as many educational and life-enriching opportunities as possible directly to youth living in public housing.

Sarasota Housing Authority is grateful for the support of Sarasota County for its Youth Thrive programming.

Homeownership

SHA’s Homeownership Program provides qualified Housing Choice Voucher (HCV) families with the opportunity to own a home. The process of purchasing a home through this program is similar to the conventional home buying process, and families can purchase a single family home, town home, condominium or cooperative anywhere within SHA’s jurisdiction.

Families will utilize the voucher assistance to pay a portion of their mortgage for up to 15 years or as long as they qualify – the same way families use a voucher to pay a portion of their rent

In addition to financial assistance toward the mortgage payment, the program provides pre- and post-purchase home buyer education, credit counseling and other services to help families navigate the home-buying process and increase their chances of success. To qualify for this program the family must already have a HCV voucher and must:

- Be a first-time homeowner or have not owned a home within the last three years

- Has a minimum income (equal to 2,000 hours of annual full time work at minimum wage).

- Have been employed continuously on a full-time basis for at least one year

- Complete a pre-assistance homeownership and housing counseling program

- For disabled families, the minimum income is equal to the monthly (SSI) benefit for an individual *Seniors and persons with disabilities may be exempt from the minimum income requirement and may be eligible for an additional term of mortgage assistance.

SHA participants who would like to learn more about this program should speak to their case manager at 361-6210.

Family Self Sufficiency

About the Program

The FSS Program is a five-year, self-paced, voluntary program designed to assist Housing Choice Voucher participants achieve economic independence. Participation requires a personal commitment by each individual to develop goals that will lead to self-sufficiency. In exchange, participants will receive supportive services and the opportunity to earn an escrow savings account.

These goals may include

- Education

- Specialized Training

- Job Readiness and Job Placement Activities

- Career Advancement Objectives

- Mentoring

- Budget/Credit Repair

- Home Buyer Education

Goals for each participating family member are set in individual training and services plans attached to the FSS participation contract.

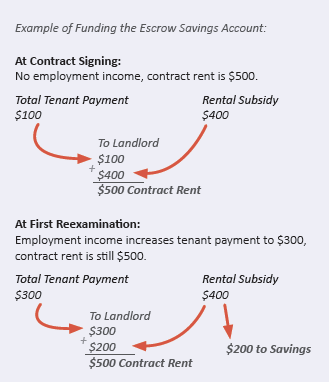

Escrow Account

The incentive of the FSS Program is a special escrow account that is set up for each participant. As the participant’s earned income goes up, the rental subsidy remains the same, with the remaining money deposited monthly into a savings account. This account belongs to the participant and is disbursed upon graduation from the program. While participating, families may borrow from their savings account once per year to help meet the needs of their personalized goals. Each graduate decides how this money can best serve the future of their family.

Requirements

Participants must:- Seek and maintain suitable employment. Must be employed six months prior to the expiration of the contract and be Welfare free of cash benefits for one year prior to the expiration of the FSS contract.

- Be the head of household and have the willingness and ability to meet program requirements.

- Work closely with a case manager to develop and carry out personal goals individualized by the participant.

Pathways to a Better Life

The Sarasota Housing Authority has developed a pilot program, Pathways to a Better Life (PBL) that partners with families for the express purpose of breaking the intergenerational cycle of poverty.

PBL is intended to assist low-income families in need of housing who voluntarily agree to work and/or be in school full time in order to put themselves and their children on a direct pathway to a better life. A two-generation approach will be utilized incorporating:

- Intensive case management to help guide and support the whole family achieve their goals;

- A major focus on early childhood education as well as education opportunities for parents;

- Economic supports with subsidized housing as well as savings accounts funded through monies the family would otherwise pay in rent as their income increases;

- Access to health screenings and services coordinated by the new Babies and Children’s Medical Center Clinic in the Glasser-Schoenbaum Center, just two blocks from our family development;

- Building on and enhancing social capital through parent networks.

- Belief in the ability of our residents

- The value of high expectations, for parents and children

- A two-generation strategy and approach to break the intergenerational cycle of poverty

- Taking ownership of and accountability for choices

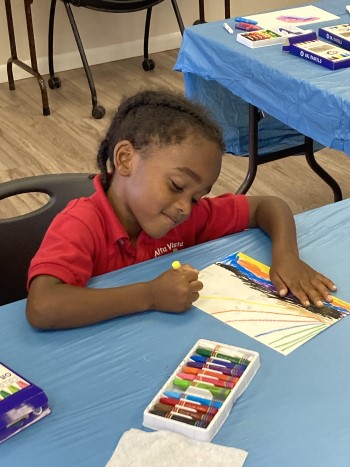

Focus on Early Childhood Literacy

The Sarasota Housing Authority (SHA) is proud to be engaged in multiple, expanding efforts aimed at eliminating the achievement gap for children growing up in public housing. The Campaign for Grade Level Reading highlights three key areas to address in order to eliminate the achievement gap: 1) School readiness, 2) Chronic absences and 3) Summer learning loss. The following is a list of initiatives and programs SHA has sponsored to do just that through effective partnership and collaboration: